Today people who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate.

~ Warren Buffet

Every penny saved is a penny earned. Owning 1 billion conventional dollars today in cash equals just 485 million USD 30 years down the line at a 2.45% inflation rate (September 2024, USA). The minimum effort before any risky investment strategies is to beat inflation and keep up with the pace of rising prices. But how does that work today in traditional finance? SBLOCs or Securities Backed Line-of-Credit, are a major investment strategy by investors in traditional financial institutions.

SBLOCs enable individuals to leverage their existing assets, whether bank deposits, stocks, bonds, or mutual funds as collateral for a flexible line of credit. This financial tool transforms static assets into working capital, allowing investors to access liquidity without selling their investments and disrupting their long-term financial strategy. But from the above chart, the share of the blue bar or the monetary value locked as fixed deposits in Business Interests grows proportional to the net worth of the user.

This implies how SBLOCs are becoming more popular and beneficial only for the cream layer of the wealthy population, this becomes even clearer by studying the barrier to entering a traditional SBLOC with an investment firm, usually, the minimum deposit or value locked is set at 250-500k USD, which acts as a friction of all the daily wage workers to keep up with inflation, who need it the most to keep up with the rising prices of the daily products.

DeFi (Decentralized Finance) brings three key properties to counter this -

Composability

Inclusivity

Transparency

The composability between DeFi protocols on-chain allows users to access multiple protocols to maximize the returns with a fixed capital. Running on automated programs, DeFi has less to no friction on capital to enter, and though the entire process is self-custodial in most cases, added transparency makes it even better as it helps users track their funds at any point in time.

Looking at the above charts, it’s clear that the total stablecoin market cap in DeFi across chains is reaching all-time highs at the moment and Solana is nearing its all-time high at almost 4 Billion USD in stables, predominantly dominated by USDC. With recent institutional integrations like PayPal launching PYUSD, the stablecoin growth story on Solana has just begun. But the same questions arise again -

Is there a safe, yield-bearing stablecoin on Solana yet? Which allows users to lock in their USDC on Solana and earn a fixed safe return on the capital? Also, allowing them to get a 1:1 wrapped USD to restake and earn rewards from composable DeFi protocols?

Enters sUSD by Solayer.

Solayer is reimagining restaking and securing the Solana network by allowing users to stake their native SOL or USDC and maximize the returns at the same time allowing developers on the network to get more blockspace and land transactions perfectly! A win-win situation for both parties! In this article, let us deep dive into the features, working mechanism, and architecture of sUSD, a yield-bearing, safe stablecoin launched by Solayer backed by one of the safest assets on the planet, T-Bills.

Understanding sUSD - Stability🤝Yield

Before jumping into sUSD, let’s take a closer look at Solayer. Solayer is an advanced restaking protocol built natively on Solana, to enable users restake their SOL or USDC to maximize the yield they can get, allowing DeFi composability by giving a 1:1 sSOL or sUSD while the deposits are locked in and at the same time securing the network by providing the stake to Endo/Exo AVS (Active Validated Services). This in turn also allows your favorite dApps to land transactions and get more onchain bandwidth as your restaking increases their weight of stake in the network, while you get better services and rewards on top of it.

sUSD is a yield-bearing stablecoin on Solana, which is pegged 1:1 to a USD and at the same time envisioned to be backed by a basket of RWAs (Real World Assets) including U.S Treasury Bills (T-Bills), Gold, Bonds, etc. The current version of sUSD is backed by short-term T-Bills, one of the safest debt securities in the world with a yield between 4-5% annually.

Solayer can bridge this gap between the real-world yield-incurring assets like T-Bills and onchain token standard on Solana by leveraging the native Token 2022 extension. How does it work? Well, minting new tokens and issuing them to the holder in the form of yield/interest at a fixed hourly or daily rate is very cumbersome. Adopting the modern Token 2022 Yield Bearing Mint extension allows mint authority (Solayer) to create a new mint (sUSD) with an interest/yield rate that can be updated without any external program/contract and at the same time the yield is compounded and added to the token value intrinsically when the token amount/value is called. This allows dynamic fetching of the token value at any given point in time. This extension also allows the mint authority to run the token without ever creating a new token or rebasing a token from the mint for updating its value, rather each token in the mint keeps its value updated all the time. We have talked enough about the yield one can earn from sUSD, let’s get deeper into the stability of the stablecoin through RWAs.

RWA Backed Non-Custodial RFQ System

RWAs are tangible real-world assets with their value existing off-chain. These include traditional financial instruments like T-Bills, Bonds, Stocks, commodities like Gold and silver, or properties like Real Estate or just cash! So in a way, the current set of stablecoins like USDC which are pegged to 1:1 USD and backed by cash reserve is nothing but an RWA-backed stablecoin. But there are a few key differences as shown in the below illustration, which makes sUSD a standout alternative as a yield-bearing stablecoin.

Traditional stablecoins are usually backed by cash as the RWA, with a 1:1 proportion of USD stored in bank reserves. Relying on these centralized liquidity providers creates a single point of failure like the recent Silicon Valley Bank episode with USDC, which depegged the stablecoin for a few days, uff, scary stuff.

Solayer breaks this dependency on banks and monopolies by implementing a decentralized Request-For-Quote (RFQ) marketplace where several liquidity providers having different types of RWAs compete to fulfill the engine-matched orders and asset requests. This approach creates a dynamic marketplace that bridges the gap between users and various RWA asset providers with a single streamlined interface. This helps users not to be restricted to a single liquidity provider, instead choose the one that provides them the best rate or yield.

Another key differentiating property of sUSD's innovation lies in its unique non-custodial framework. Most RWA-backed stablecoins in the market today, despite their decentralization claims, ultimately depend on centralized entities to custody their underlying assets. sUSD takes a fundamentally different approach by implementing an automated RFQ (Request-for-Quote) system through smart contracts, where Qualified Liquidity Providers (QLPs) maintain direct control of their TBILL tokens within their designated Program Derived Accounts. Let’s dive a bit further to see how the above RFQ marketplace works at its core.

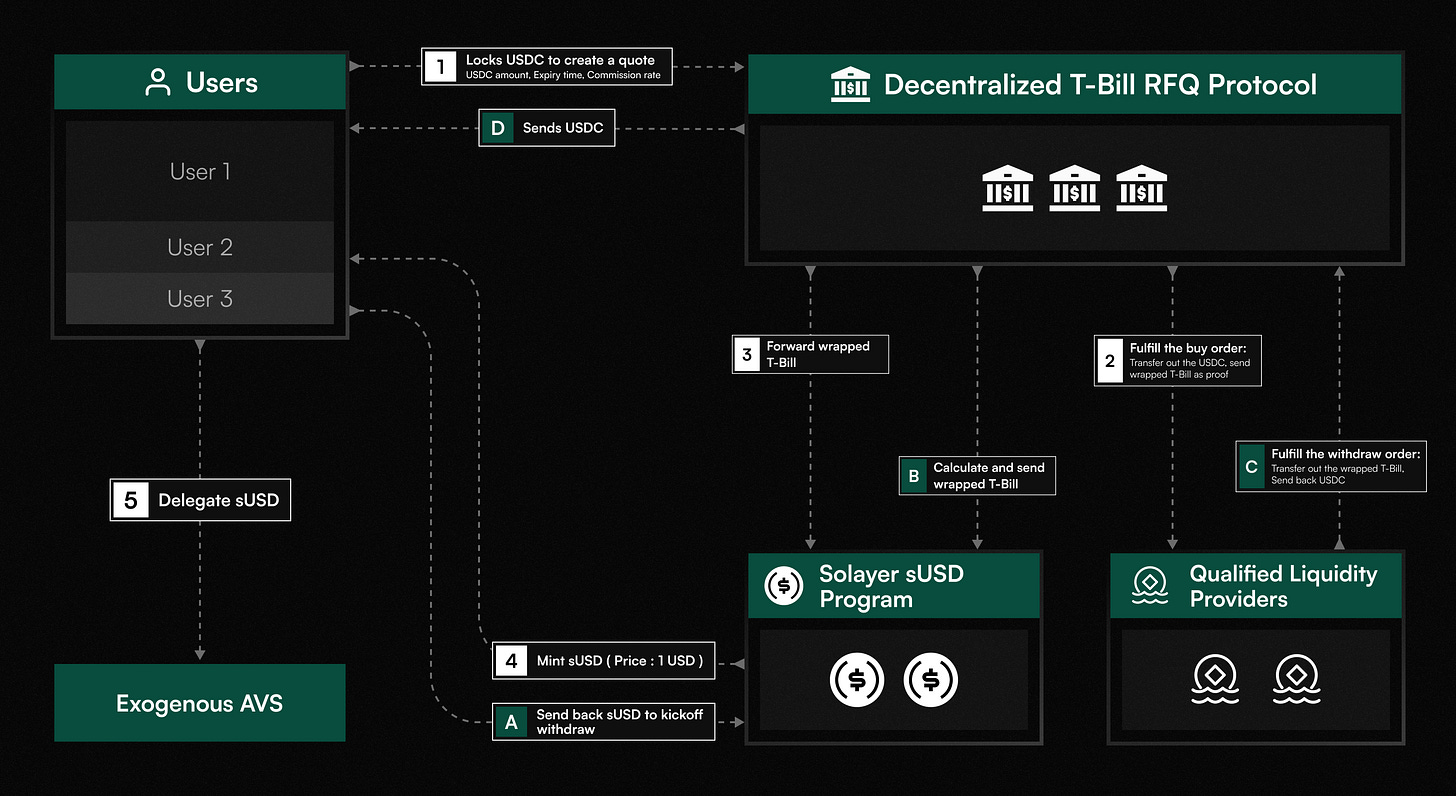

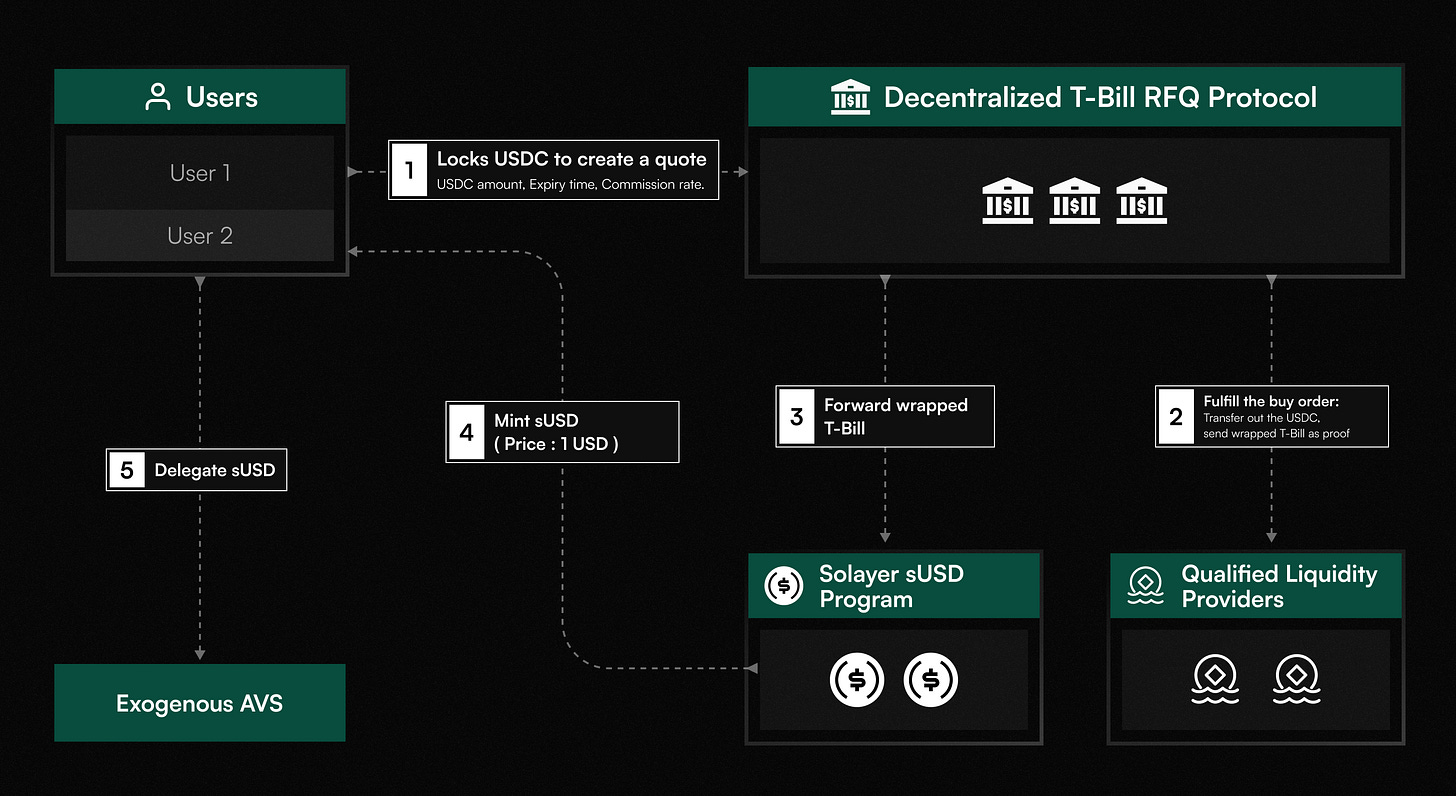

As discussed above RFQ protocol (Request for Quote) protocol is a marketplace matching engine. The entire matchmaking (minting, redemption, and order matching) between the USDC quotes and qualified tokenizers happens in a non-custodial fashion through onchain programs running on Solana. This protocol has two phases called Subscription and Redemption involving multiple actors like users, and heterogeneous RWA liquidity providers accessible through a unified single interface.

The Users are the most important stakeholders in the entire protocol, who bring in and lock the USDC into the program running the logic behind RFQ. They are also responsible to delegate or restake their tokens further in a multi-layered fashion into composable DeFi protocols to earn additional yield and secure the network at the same time, more on that in next sections.

Qualified Liquidity Providers (QLPs) are the market makers, who provider the marketplace with the requested tokenized form of RWA. Right now short-term T-Bills are running live on the network, enabling verified liquidity providers to lock in the T-Bills in vault and gain access to equivalent T-Bill tokens to provide liquidity in the network when required.

Subscription Process

The subscription process starts with users depositing/locking their USDC with a -

Expiry Date or the Lockup Period (can be broken at any time with a T+1 return mechanism)

Commission Rate (Basis Points)

The better the commission rate, the faster and deeper liquidity options one would get. And people would need to pay the commission points only while retrieving the deposits back. Once the order is sent to the sUSD program, the RFQ protocol broadcasts the requested order to all the liquidity providers, and this enables an unbiased, transparent market-making and best price/quote discovery.

Once the best market maker for this request has been found, the market maker sends back a wrapped T-Bill token to the network, which is a 1:1 representation of the privately locked T-Bills.

This wrapped T-Bill is sent to the sUSD mint program which gets locked with the program, and the program logic mints new sUSD tokens with a 1:1 proportion of the sent wrapped T-Bills. These tokens are transferred to the user, which further can be used to delegate to “Exogeneous AVS“ (yes, we’ll cover what’s it all about), for now, think of it as one of the composable multi-layered DeFi yield options sUSD unlocks for the users.

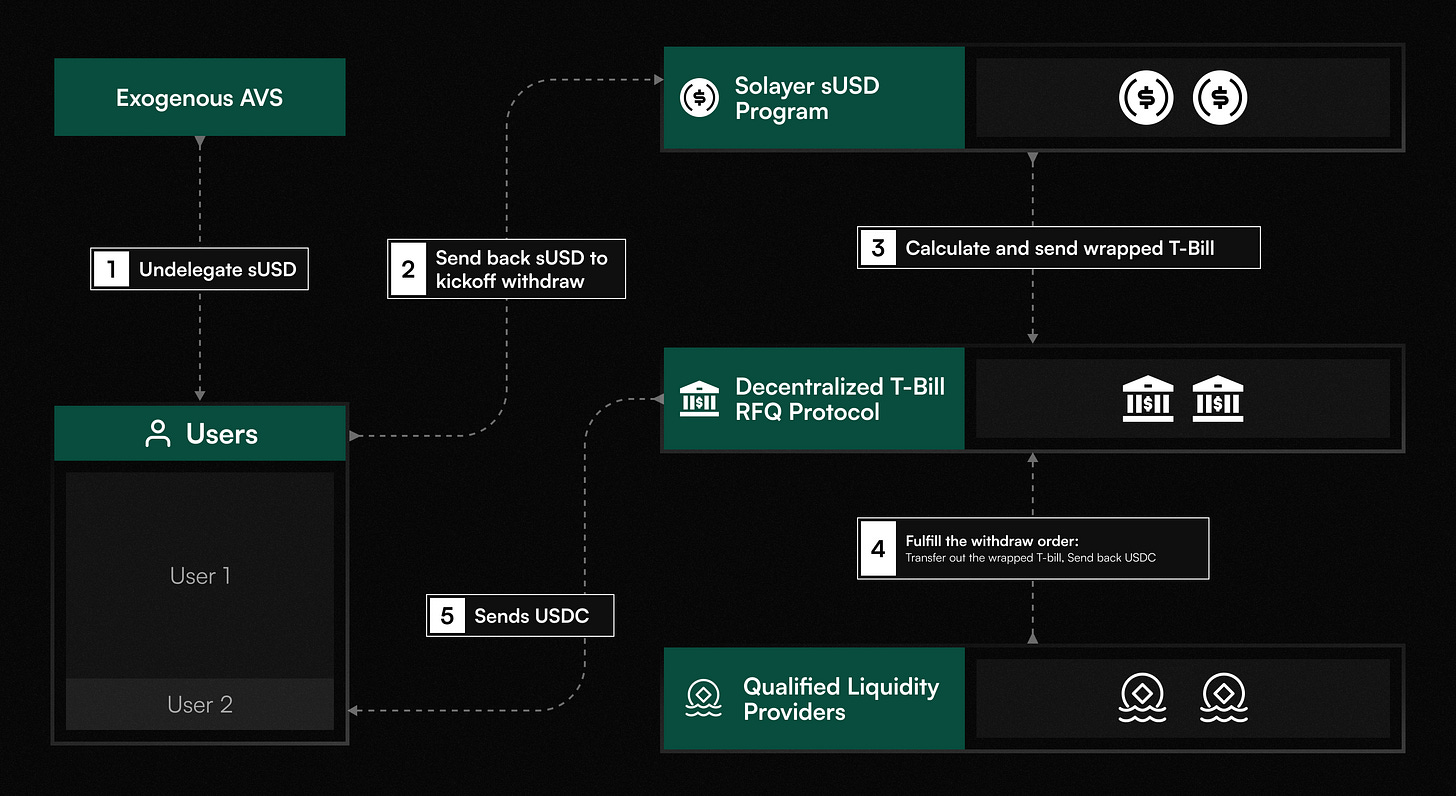

Redemption Process

The Redemption process is as straightforward as the subscription process, the user needs to unlock the delegated sUSD tokens and send them back to the same sUSD program, which fetches the proportional amount of locked wrapped T-Bills and sends it across to the RFQ protocol.

The RFQ protocol performs the redemption matchmaking process looking for all the liquidity providers and market makers who provide the best quote to purchase these wrapped T-Bills and send back the USDC to the user through the network.

Yield Generating Mechanisms: sUSD🤝DeFi

As described in the previous section, Solayer takes a multi-layered composable yield-generating approach with sUSD. This means that apart from backing the sUSD token with appreciating or yield-generating RWAs, the architecture also allows users to delegate these sUSD tokens to popular dApps around the Solana ecosystem. This triggers a win-win situation for all the parties, the network, the dApps, and the users! How? Let’s find out now -

Imagine someone taking a red pill and another taking the blue pill from the matrix, each one forms their niche stack of dApps and services on Solana. The blue team consists of endogenous dApps like - Raydium swap, GMGN, Meteroa, and exogenous services like Pyth and Sonic. Similarly, the red team consists of Orca, Pump.fun and Kamino as endo AVS, and Switchboard, Eclipse as exo AVS. Before going any further let’s understand what endo and exo AVS are in terms of Solayer. Endogenous applications are dApps built on Solana to provide services in domains like DeFi, DePin, etc. Exogenous Services are applications built to run parallel to Solana like Rollups, Bridges, Oracles, etc. And AVS standards for Active Validator Set.

On Solana, as a blockchain that follows PoS (Proof of Stake) variant of the consensus algorithm, having a higher stake gives a validator a higher chance of getting blockspace and landing a transaction. And dApps or services that delegate higher stakes to these validators would be given more blockspace and enough bandwidth to manage heavy onchain traffic.

And as users Solayer, wants you to have a multi-layered yield on top of the 4-5% yield that the T-Bills provide. To make this happen Solayer enables you to delegate your sSOL to Endo-AVS dApps (live now) and sUSD to Exo-AVS service. Now imagine you being in the red team, who regularly uses Orca and Pump.fun to manage swaps and memecoin madness, and Kamino to optimize your earning, delegating them your tokens would bring them more blockspace and priority inclusion, at the same time, improves your dApp experience and also earns your rewards and additional yield from these dApps. The same goes with the Exogenous set of AVS, it allows you to earn through services like Bridges, Oracles, and Rollups.

Using sUSD👷

Depositing and Withdrawing the USDC funds is done through a single interface at the https://app.solayer.org/. This hides all the complexities of the RFQ spec, sUSD minting, and management programs in the background.

Security and Transparency

The core primitive of sUSD is the decentralized RFQ spec/protocol replacing centralized banks while backing the token. This comes with the above advantages, on the left we can see the sUSD mint page from the explorer which displays the interest-bearing token 2022 standard and the current rate of interest offered by the protocol stands at 4.21%. And the current supply of sUSD stands at over 21 million USD, already making it the 5th largest stablecoin on Solana. We can also look at one of the T-Bill market makers Solayer is working with right now, OpenEden. The explorer gives a clear idea of how many wrapped T-Bill tokens each market maker like OpenEden holds, to make sure the RFQ protocol is performing a fair matchmaking. The security of the protocol has been audited by Halborn.

Final Thoughts & Potential Usecases with sUSD🏁

"The future of finance isn't about replacing the old, but building better alternatives"

As we wrap up our deep dive into sUSD, let's consider what yield-bearing stablecoins mean for the evolving DeFi landscape. The concept is straightforward - combining the stability we need with the yields traditional finance typically reserves for institutions.

sUSD presents several interesting use cases worth considering:

Think of it as a digital savings alternative. The automatic yield generation (4-5% APY) from real-world assets offers a straightforward way to put stable assets to work. No complex strategies or active management are required.

For DeFi users, it adds another tool to the toolkit. Whether it's serving as collateral, facilitating trades, or participating in protocol security through restaking - while maintaining exposure to base yields. This opens up interesting possibilities for capital efficiency.

The payments angle is particularly noteworthy. Having a stable value that generates returns until the moment of transaction could change how businesses and individuals think about managing their liquid assets.

The broader conversation here isn't about any single solution, but about how DeFi continues to evolve. As the line between traditional and decentralized finance blurs, innovations like yield-bearing stablecoins represent interesting experiments in making finance more accessible and efficient.

Whether these solutions become mainstream will ultimately depend on user adoption, market dynamics, and how the regulatory landscape evolves. What's clear is that the exploration of better financial primitives continues, and that's good for everyone.

💌

Thank you,

Resources -

https://docs.solayer.org/susd/what-is-susd